As AI becomes a core part of modern trading, one question keeps popping up among serious traders and analysts:

What’s the difference between GPTs and structured prompt systems like ChatGPT Pro Frameworks?

If you’re using ChatGPT as a trading assistant, this isn’t just a technical distinction—it’s a strategic one. Understanding how these tools work under the hood could mean the difference between vague AI output and a system that delivers real trading edge.

In this post, we’ll break down the difference between GPTs and Pro Frameworks, and show why Pro Frameworks are built entirely around the more powerful, native approach.

What Are GPTs?

GPTs (also known as “Custom GPTs”) are mini apps or chat assistants built using OpenAI’s GPT-4 model. Users can create a GPT by giving it instructions, uploading files, and setting behavior through a simple interface. These GPTs are accessible via the GPT Store.

Think of GPTs as pre-packaged wrappers around ChatGPT’s core engine. They allow casual users to quickly set up a focused assistant—like one that answers questions about real estate, summarizes PDFs, or explains chess strategy.

They’re useful for light use cases. But for serious trading work? There are limitations.

GPTs Are Sandboxed by Design

GPTs run in isolated, sandboxed environments without persistent memory, limiting adaptability. They operate on GPT-4’s reasoning engine but only within the fixed instructions set by their creators. This often results in more scripted, less adaptive intelligence compared to a structured prompt sequence running inside full ChatGPT.

While GPTs run in isolated environments without persistent memory, limiting adaptability, they still operate on GPT-4’s powerful reasoning engine. However, their capabilities are confined to the fixed instructions set by their creators, resulting in outputs that often feel scripted and less adaptive than a well-structured prompt sequence running inside the full ChatGPT interface.

Worse still, GPTs rely heavily on the UI and GPT Store framework, which introduces friction, latency, and reduced flexibility — especially when markets move fast. If you’re a trader looking to rapidly test scenarios, run multi-layered simulations, or adapt prompts in real time based on shifting conditions, GPTs will likely feel sluggish, shallow, and restrictive.

What Are ChatGPT Pro Frameworks?

ChatGPT Pro Frameworks aren’t separate GPT apps or hidden features — they are structured prompt frameworks designed to run natively inside ChatGPT itself. There are no wrappers, plugins, or custom code involved. Instead, these frameworks are built through carefully designed, multi-layered prompt sequences that unlock ChatGPT’s full reasoning power for institutional-style trading analysis.

Most importantly, these structured prompt frameworks give you full access to ChatGPT’s advanced reasoning engine, letting you tap into multi-layered logic, adapt prompts on the fly, and simulate changing market conditions with speed and clarity. While they don’t have live market data, you can feed in updated context, test dynamic scenarios, and generate updated trade playbooks in seconds — all from inside a single, powerful interface.

How Our Prompt Framework Works

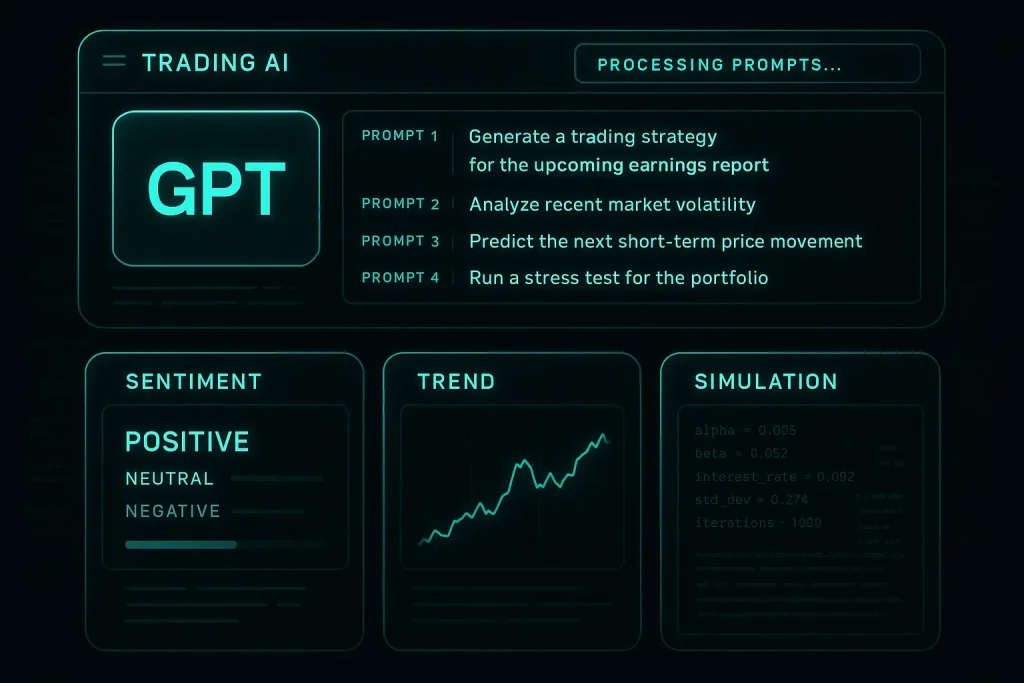

Take the prompt framework developed by The Richo Edge. This isn’t just a clever prompt — it’s a multi-layered precision framework built to transform ChatGPT into a full-spectrum trading assistant. The design mirrors how institutional desks operate: structured inputs, adaptive logic, and rapid decision support — all running inside ChatGPT’s core engine.

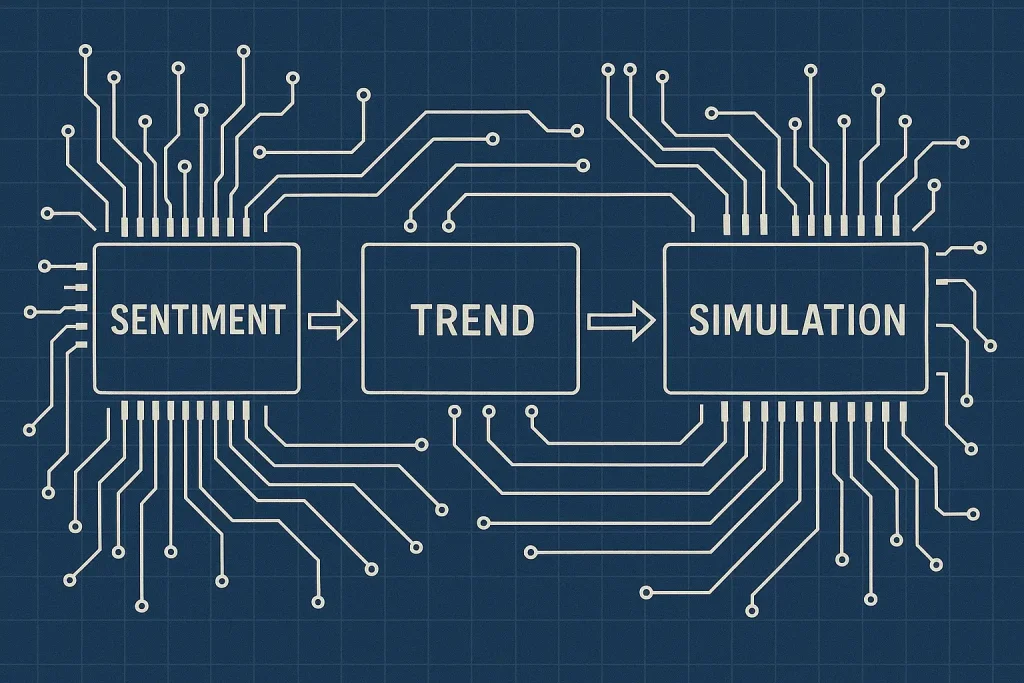

We begin by multi-layer priming ChatGPT through a sequence of targeted precision prompts—decoding sentiment, tracking trend momentum, and simulating real-world risk scenarios. Each prompt phase builds on the previous one, guiding ChatGPT through a logical framework that reflects how analysts and traders think in live market environments.

The result? ChatGPT doesn’t just chat — it runs internal reasoning loops, processes up-to-date market context provided via prompts, and outputs a risk-aware trading playbook built for decision-making. No plugins. No sandbox. No slow interfaces. Just a clean, flexible, real-time framework for reasoning — all happening directly inside ChatGPT.

Why This Matters for Traders

In markets, speed and adaptability win. You don’t have time to reload a GPT every time you want to test a new scenario. And you definitely don’t want rigid tools that lock you into predefined logic or force you to start over mid-session. That kind of friction costs time — and in trading, time is edge.

Pro Frameworks are built for real-time flexibility. You can modify and fine-tune prompts on the fly, layer new instructions based on evolving data, and inject custom logic at any point — all without breaking the workflow.

It’s the difference between using a calculator someone else built… and coding your own formula live, in the terminal. For traders, that’s not just convenience — that’s control.

The Richo Edge: Built on Pro Frameworks, Not GPTs

At The Richo Edge, every pro framework is built using structured prompt logic inside full ChatGPT — not pre-coded GPTs or scripted assistants. And there’s a reason for that. GPTs are static, locked into fixed logic and shallow instruction sets. Pro Frameworks, on the other hand, are dynamic. They adapt, evolve, and run live inside the full reasoning engine of ChatGPT. And in trading — where speed, context, and flexibility define edge — dynamic wins.

With The Richo Edge’s Pro Frameworks, you’re not just chatting. You’re running structured, professional-grade AI workflows designed for market decision-making. You get real-time sentiment decoding, pulling in mood and tone from news, social chatter, and price action to surface the emotional layer behind the move. You get trend momentum tracking through layered prompt sequences that follow price and volume strength — not just direction, but conviction.

You also unlock market simulation playbooks, allowing you to stress-test positions against macro events, sector rotations, or geopolitical risk. And most importantly, you get prompt flow blueprints — systems that mirror how real analyst desks run layered queries, adapt logic midstream, and feed insights directly into trade setups.

And all of this runs natively inside ChatGPT. No plugins. No apps. No sandbox restrictions. Just direct, clean, flexible intelligence — built for real-time market work.

Common Questions

“Can’t I just make a GPT that does the same thing?”

Technically? Maybe. Practically? Not even close.

GPTs are static. They lock in the behavior. You lose flexibility. Worse, you lose context between prompt layers unless you build elaborate chains. Pro Frameworks let you shift strategy mid-session without breaking flow.

“Are Pro Frameworks hard to learn?”

Not if you’re using a structured framework like those from The Richo Edge. Each framework follows a clear prompt sequence — Sentiment, Trend, Simulation, and Implications. Just drop them in — and go.

“Why doesn’t everyone do this?”

Most people don’t know how. Prompt architecture is a skill — and building adaptive frameworks takes time. That’s why this system exists: so traders can focus on the edge, not the engineering.

Final Thoughts: GPTs Are Apps. Pro Frameworks Are Systems.

If you’re a trader, you don’t need another app. You need a framework—something that adapts with you, sharpens over time, and delivers clarity when the market doesn’t. That’s the real difference between GPTs and Pro Frameworks.

GPTs are fun to explore—like demos, they hint at what’s possible. Pro Frameworks are built for function—they run like terminals, not toys. Where GPTs suggest, Pro Frameworks execute. Where GPTs show potential, Pro Frameworks deliver precision—fast, repeatable, and adaptable.

So the next time someone shows you a flashy trading GPT, ask yourself:

Is this a system I control — or a box I’m stuck in?

Because in markets, control isn’t optional. It’s everything.

At The Richo Edge, we don’t build gimmicks. We build systems. And we teach you how to run them like a pro.

To learn where frameworks are heading, read The Future of Trading: AI Prompt Frameworks for Retail Traders.